employee stock option tax calculator

Ad Fidelity Has the Tools Education Experience To Enhance Your Business. The strike price of.

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

The Stock Option Plan specifies the employees or class of employees eligible to receive options.

. In the event that you are unable to calculate the gain in a particular exercise scenario you can use the. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in.

If you exercised 1000 shares you would have paid a base exercise cost of 20000 1000 shares x 20share and potentially owed taxes on the assumed gain of 80000 1000. Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value. You will pay a total of 765 on gains if your year-to-date earned income is less than the base when you exercise NQ stock options.

Cutting-edge software backed by the support of highly-experienced equity professionals. How to calculate the tax on share options. The calculator is very useful in evaluating the tax implications of a NSO.

On this page is an Incentive Stock Options or ISO calculator. The relevant tax on share options is paid at 52 See example below on how to calculate share profit. The Stock Option Plan specifies the total number of shares in the option pool.

Your payroll taxes will switch to 145 on. The tool will estimate how much tax youll pay plus your total return on an ESPP investment under three scenarios. Skip to main content.

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. Ad Fidelity Has the Tools Education Experience To Enhance Your Business. Ad Innovative stock option plan management tools backed by deep expertise.

Click to follow the link and save it to your Favorites so. Enter the current stock price of your company the strike. Any compensation income received from your employer.

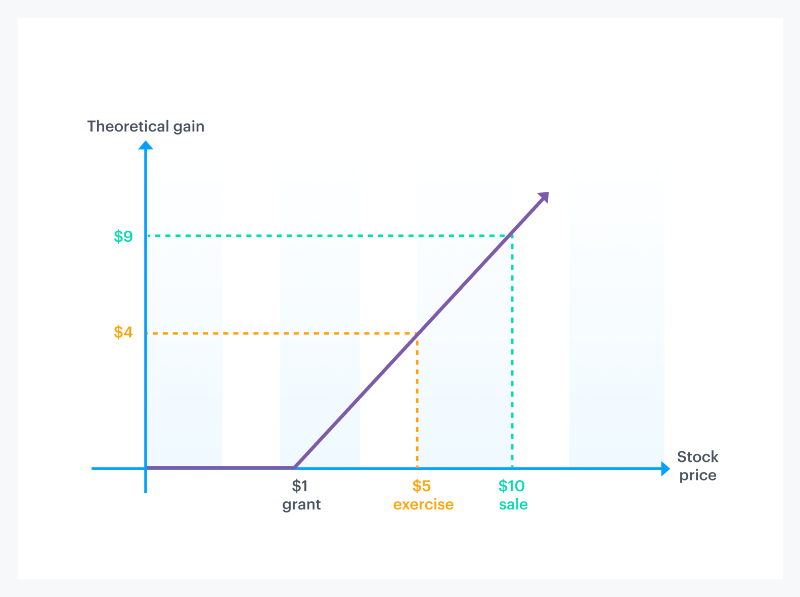

If you sell immediately you are paying 20000 for something that is worth 60000. Stock Option Tax Calculator Calculate the costs to exercise your stock options - including taxes. If you decide to exercise when the stock price is 5 your theoretical gain is 4 per share.

Taxes for Non-Qualified Stock Options. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the. What We Offer.

Locate current stock prices by entering the ticker symbol. Let us introduce Emily who exercised her. Tool Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in.

For nonstatutory options without a readily determinable fair market value theres no taxable event when the option is granted but you must include in income the fair market. On the date that you decide to exercise your shares the stock is actually worth 30 per share. Answer Your basis in the stock depends on the type of plan that granted your stock option.

Lets say you got a grant price of 20 per share but when you exercise your. Exercising your non-qualified stock options triggers a tax. Use the employee stock option calculator to estimate the after-tax value of non-qualified stock options before cashing them in.

This permalink creates a unique url for this online calculator with your saved information. On this page is an employee stock purchase plan or ESPP calculator. As the stock price grows higher than 1 your option payout increases.

With the regulation of tax options brokers in Australia came the option of strict calculators affecting the terms and quality of. Option exercise calculator this calculator illustrates the tax benefits of exercising your stock options before ipo. Binary Options Signals Optimize Your Trading so.

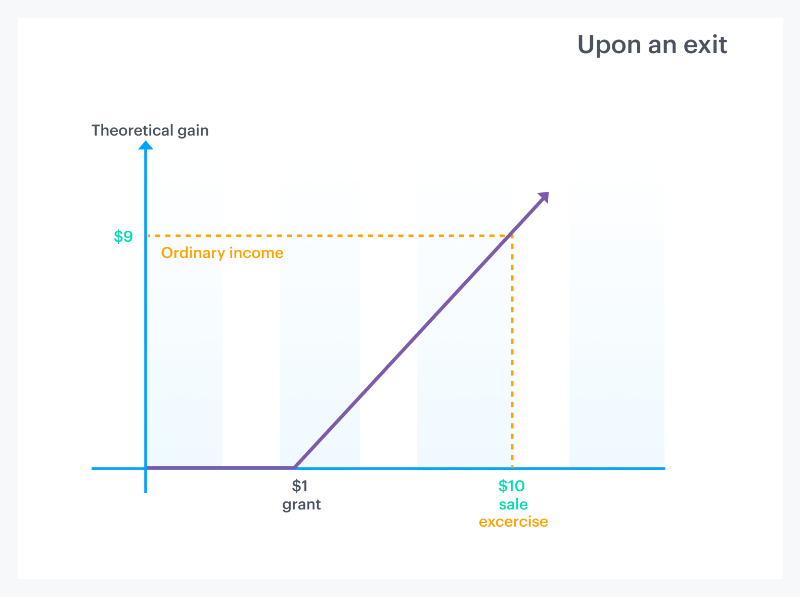

The ordinary income might be more than the gain on the sale. Subtract the amount paid for the stock option price. AMT Calculator Exercise incentive stock options without paying the alternative.

Ad Innovative stock option plan management tools backed by deep expertise. An employee stock ownership plan also known as employee stock option. The stocks basis is the total of both.

If you have any further confusion regarding the calculation of taxes related to your incentive stock options be sure to discuss any questions that you have with your employer as soon as. This information may help you analyze your financial. ESOP gain but Zero Risk Strategy.

The following calculator enables workers to see what their stock options are likely to be valued at for a range of potential price changes. Cutting-edge software backed by the support of highly-experienced equity professionals. How much are your stock options worth.

Tips To Make The Most Of Your Esops Businesstoday

How Stock Options Are Taxed Carta

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

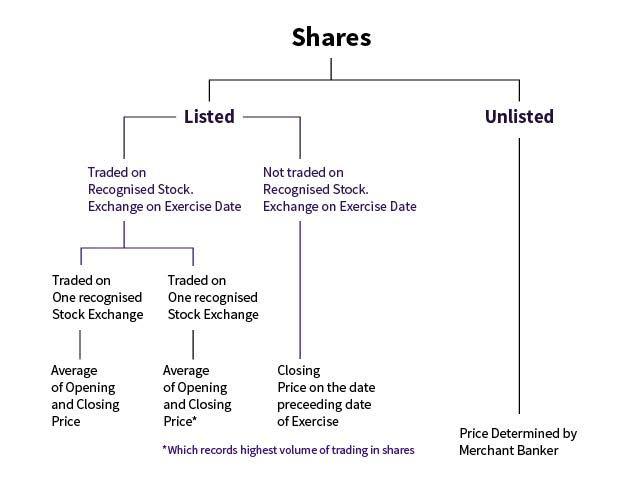

Employee Stock Option Plan For An Unlisted Company

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Option Eso Definition

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

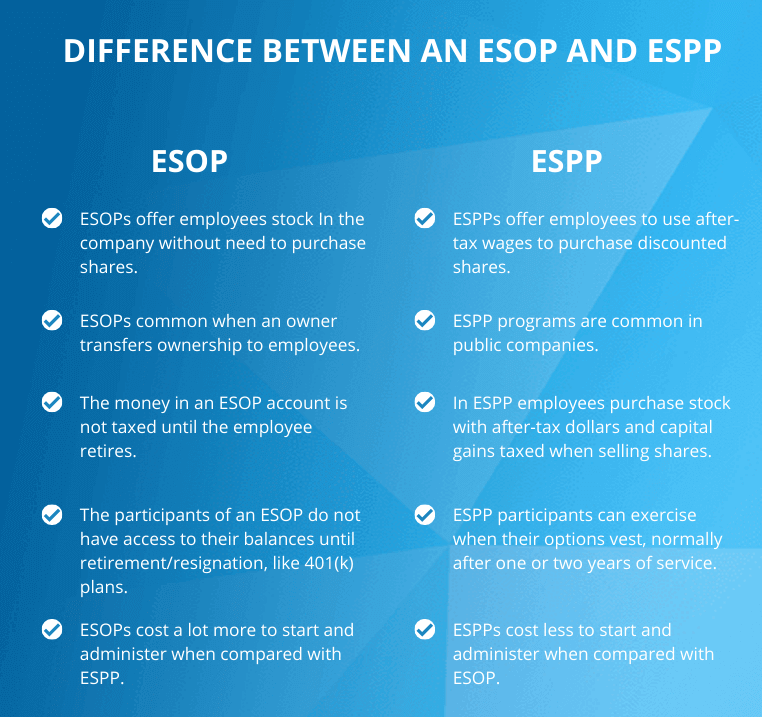

Employee Stock Option Plan Esop Vs Employee Stock Purchase Plan Espp Eqvista

Stock Options 101 The Essentials Mystockoptions Com

Getting Esop As Salary Package Know About Esop Taxation

Tax Planning For Stock Options

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

How Stock Options Are Taxed Carta

Employee Stock Options Financial Edge