georgia ad valorem tax motorcycle

Best tool to create edit share PDFs. This means that it will vary depending upon whether it is a new motorcycle that you have bought or a used one.

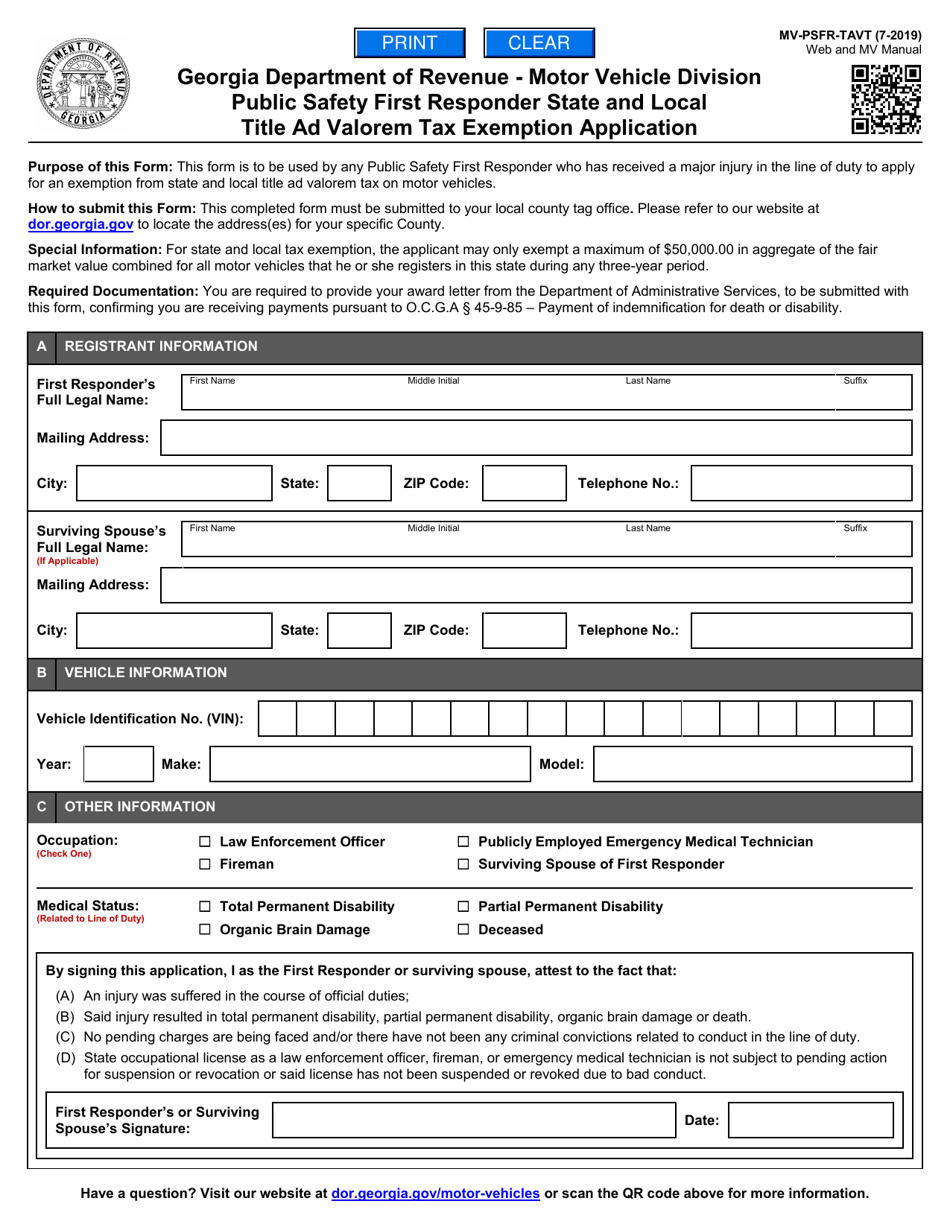

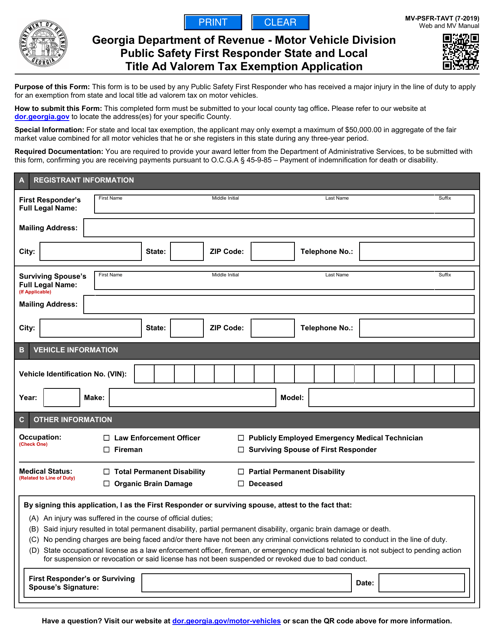

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

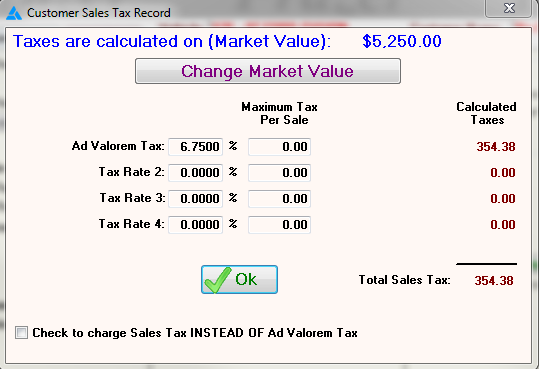

For an estimate use the MVDs ad valorem tax calculator.

. 2021 Property Tax Bills Sent Out Cobb County Georgia 25 of the tag fees. The basis for ad valorem taxation is the fair market value of the property which is established January 1st of each year. In South Dakota we pay a one-time 3 excisesales tax the first time we register a vehicle.

The tax base was defined in terms of physical units such as gallons pounds or individual items. The actual filing of documents is the veterans responsibility. Ad Register and Subscribe now to work with legal documents online.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. According to Chapter 22 of Publication 17 the IRS allows you to deduct the ad valorem tax vehicle value off your income taxes. Do 100 disabled veterans pay sales tax on vehicles in Georgia.

I think it starts out around 30 per year on a new bike and it goes down a little each year until the vehicle is. Motorcycles may be subject to the following fees for registration and renewals. This calculator can estimate the tax due when you buy a vehicle.

Cost and Fees Distribution. Literally the term means according to value. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Motorcycle or commercial motor vehicle with an unladen weight of 8000 pounds or less that is not used. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. 1 to the County Tag Agent.

As of 2018 residents in most Georgia counties pay a one-time 7 percent ad valorem tax on these vehicles at the time of purchase. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. 393 Type of Motorcycle Currently Riding.

Cost to renew annually. Of the Initial 80 fees collected for the issuance of these tags the fees shall be distributed as follows. Ad valorem tax any tax imposed on the basis of the monetary value of the taxed item.

66 title ad valorem tax TAVT. Registration Fees Taxes. The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state.

Traditionally most customs and excises had specific rates. 20 Annual License Reg. Vast library of fillable legal documents.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. Persons who are 100 Service Connected Disabled are exempt from Ad Valorem Tax andor TAVT on one vehicle only. Based on weight 12 minimum 5.

In 2013 Georgia created the Title Ad Valorem Tax or GA TAVT for vehicles purchased in March 2013 and later. 80 plus applicable ad valorem tax. 59 to State of Georgia General Treasury.

How do I calculate ad valorem tax. 2012 Black Cross Country. 18 title fee and 10 fees for late registration.

The tax must be paid at the time of sale by Georgia residents or within six months of establishing residency by those. The amount is calulated on the purchase price less any trade-in value. Ad valorem tax more commonly known as property tax is a large source of revenue for governments in Georgia.

FOR AD VALOREM TAX or TITLE AD VALOREM TAX EXEMPTIONTAVT. 5500 plus applicable ad valorem tax. This tax is based on the value of the vehicle.

Based on the market value of your motorcycle. Georgia ad valorem tax motorcycle Wednesday March 9 2022 Edit. Then it is just a yearly registration fee after that.

Ad Valorem taxes are calculated based on the vehicles assessed value. Anybody registered a 2012 or 2013 victory in Georgia brought in from another. Jul 26 2012 Messages.

Jan 14 2015 1. Georgia Department of Revenue gives in depth information on the exact required amount of fee particularly the amount you have to pay as an ad valorem tax which is based on the current market value of your motorcycle. The tax is levied on the assessed value of the property which by law is established at 40 of the fair market.

Title Ad Valorem Tax TAVT became effective on March 1 2013. Georgia Ad Valorem tax Discussion in Victory General Discussion started by Bobbyd85 Jan 14 2015. Military members are exempt from assessment and property taxes upon registration renewal.

Georgia Vehicle Sales Tax Fees Calculator Find The Best Car Price

Georgia Department Of Revenue A Motor Vehicle Division Title Ad

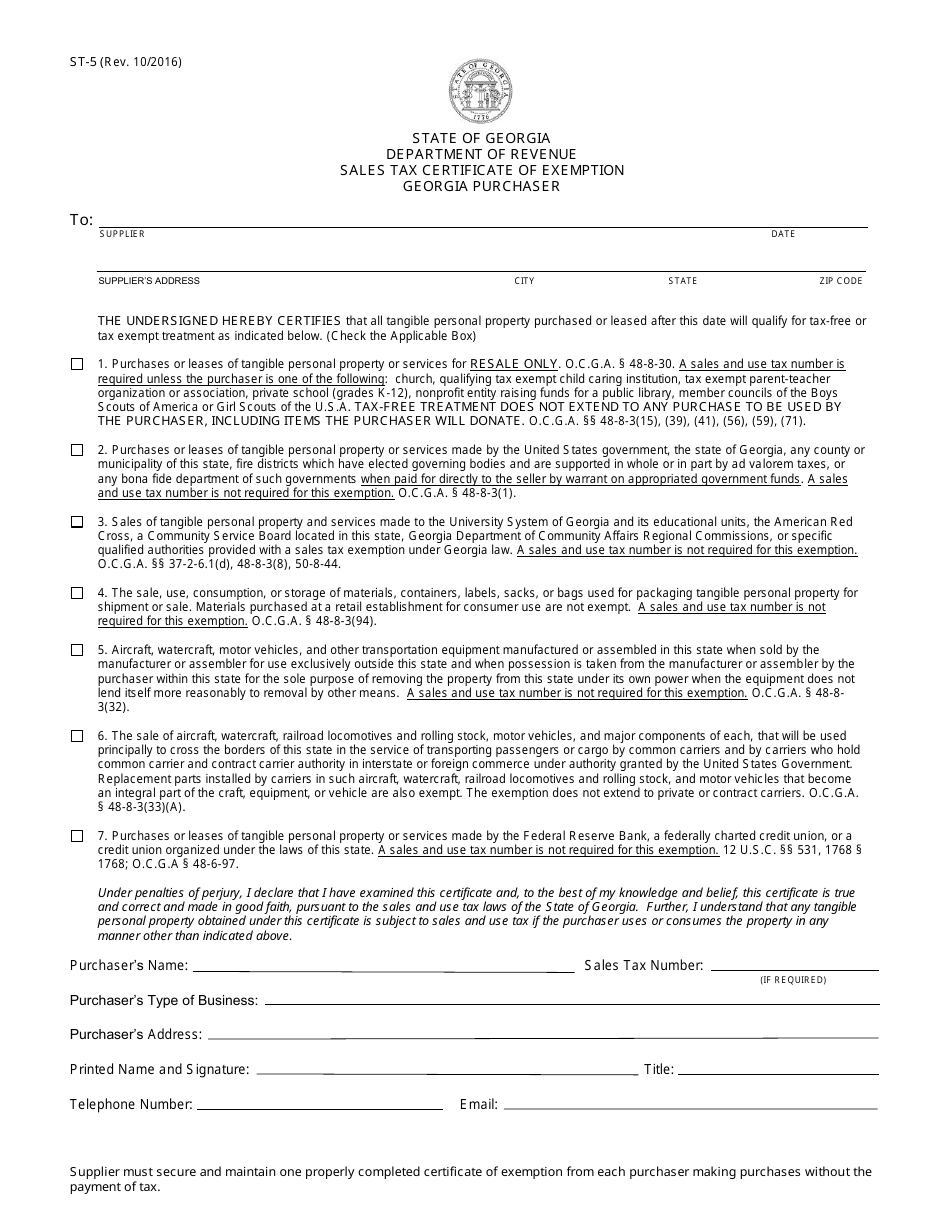

Form St 5 Download Fillable Pdf Or Fill Online Sales Tax Certificate Of Exemption Georgia Purchaser Georgia United States Templateroller

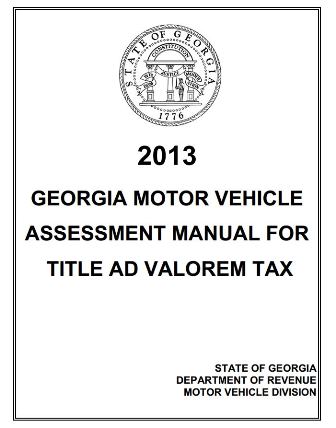

Georgia Motor Vehicle Ad Valorem Assessment Manual

2013 Vehicle Valuation Manual Title Ad Valorem Tax Diminished Value Of Georgia

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

Tax Rates Gordon County Government

Frazer Software For The Used Car Dealer State Specific Information Georgia

Form Mv Psfr Tavt Download Fillable Pdf Or Fill Online Public Safety First Responder State And Local Title Ad Valorem Tax Exemption Application Georgia United States Templateroller

Hey Y All Did You Hear The Report

![]()

Georgia New Car Sales Tax Calculator

Georgia Title Ad Valorem Tax Updated Youtube

Form T 146 Fillable Irp Exemption To Title Ad Valorem Tax Fee Application